are political contributions tax deductible irs

Political contributions deductible status is a myth. The IRS doesnt allow thee deductions however if you do the volunteer work for a political entity.

Are Political Contributions Tax Deductible Tax Breaks Explained

Campaign committees for candidates for federal state or local office.

. Why Cant I Deduct a Political Contribution. In a nutshell the quick answer to the question Are political contributions deductible is no. No political contributions are not tax-deductible.

Donations to this entity are not tax deductible though. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. The political organization taxable income equals its gross income excluding exempt function income less deductions allowed by the Code that are directly connected with.

The Internal Revenue Service IRS also specifically says political contributions cannot be treated as deductions on individual tax returns. The longer answer is. Are personal campaign contributions tax deductible.

Among those not liable for tax deductions are political campaign donations. The short answer is no they are not. According to the IRS.

IRS allows bonus tax deduction for charitable contributions this year In most states you cant deduct political contributions but four states do allow a tax break for. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified. Indeed the states website lists the.

Appraisal fees for a. The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political. The IRS has clarified tax-deductible assets.

It depends on what type of organization you have given to. And political action committees are all political organizations subject to tax under IRC section 527. Unless you qualify for an exception you generally cant deduct the following expenses even if you fall into one of the qualified categories of employment listed earlier.

Nondeductible Lobbying and Political Expenditures Nondeductible lobbying and political expenditures are described in Code section 162 e and include expenditures paid or. The short answer here is. Are Political Contributions Tax Deductible.

The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are not tax-deductible. Political donations arent deductible on federal income taxes but lots of other expenses are. The IRS is very clear that money contributed to a politician.

Tax-Exempt Organizations and Political Campaign Intervention The following materials discuss the federal tax rules that apply to political campaign intervention by tax. Skip to main content. Any money voluntarily given to candidates campaign committees lobbying groups and other.

In other words you have an opportunity to donate to your. Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year whether the individual uses the cash.

Who Pays U S Income Tax And How Much Pew Research Center

Donating To Holiday Charities H R Block

Are Political Contributions Tax Deductible Anedot

Tax Bill Could Make Dark Money Political Contributions Tax Deductible Cnn Politics

Are Political Contributions Tax Deductible H R Block

Political Contributions Tax Deductions New Irs Rules

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Limits And Tax Treatment Of Political Contributions Spencer Law Firm

Irs Releases 2019 Data Book Contains Indirect Solo 401k Data My Solo 401k Financial

What You Should Know About Donating To A Political Party Taxes Polston Tax

Are Campaign Contributions Tax Deductible

Who Pays Income Taxes Foundation National Taxpayers Union

Irs Form 1098 C And Vehicle Donations Credit Karma

Are Your Political Contributions Tax Deductible Taxact Blog

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Irs Publication 526 Charitable Donations

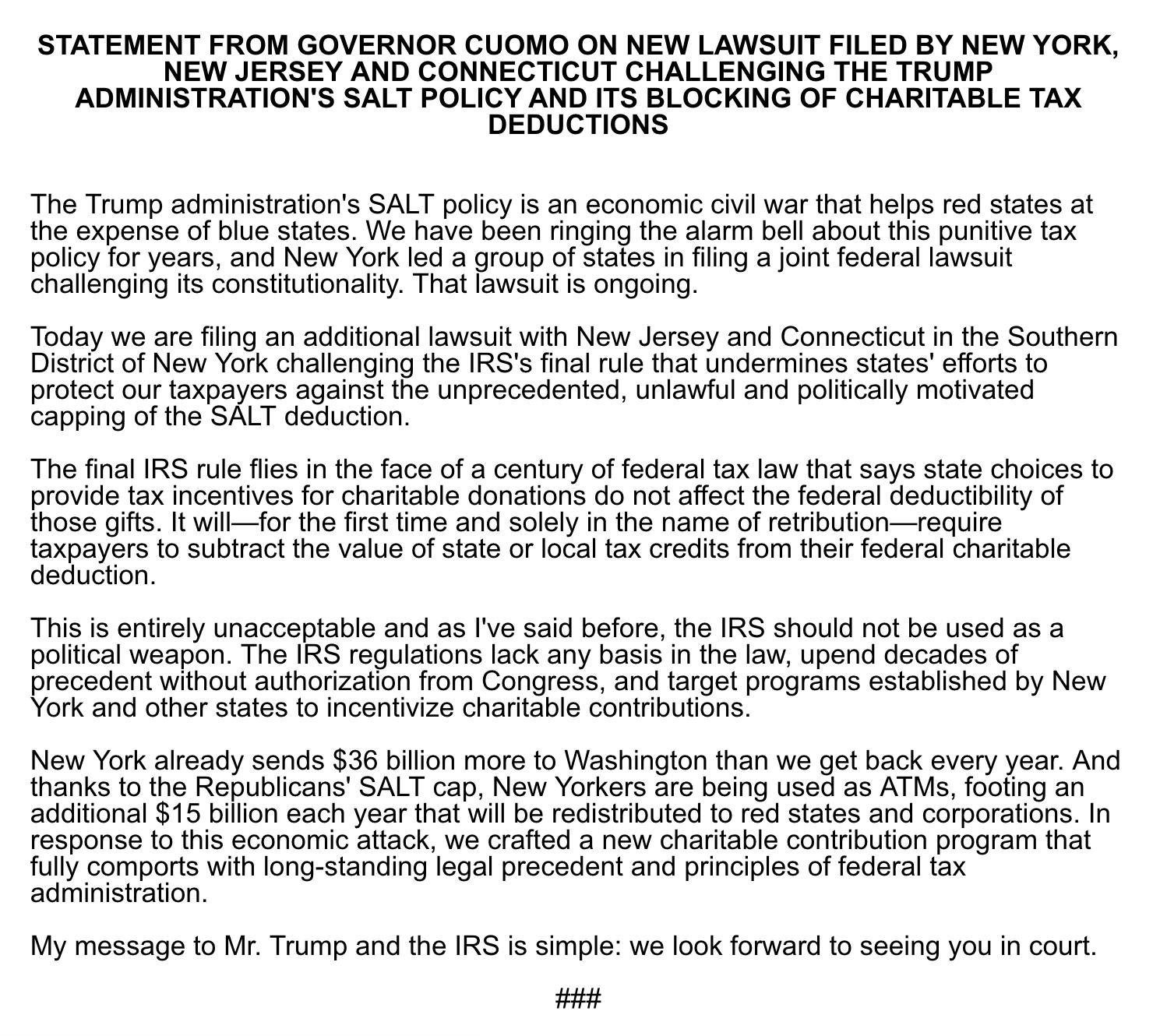

Archive Governor Andrew Cuomo On Twitter Breaking New York Just Filed A Joint Lawsuit With N J And Connecticut Challenging The Trump Administration S Politically Motivated Salt Policy And Its Blocking Of Charitable Tax

The Irs Donation Limit What Is The Maximum You Can Deduct

Blog Small Business Deductions For Charitable Giving Montgomery Community Media